VAT Relief

If you are chronically sick or disabled or a charity, you may be able to purchase certain qualifying items without having to pay VAT. You can claim this VAT relief during the online checkout process or over the phone.

Who is eligible for VAT relief?

To be eligible, you must be either:

- An individual who is:

- a. chronically sick (meaning long-term not temporary), or

- b. disabled (long-term condition with a substantial adverse effect on ability to carry out day-to-day activities)

- Or a charity which serves the needs of disabled people.

The purchase must be for personal or domestic use, not business use.

If it is for the personal or domestic use of someone else, such as a relative,

friend or neighbour, that is also permitted.

Which products qualify for VAT relief?

Generally products qualify if they are designed solely for use by a disabled person.

However, there are detailed rules about many types of products.

If a product we sell qualifies for VAT relief, you will see it marked with a VAT relief price on our website.

Remember not all products qualify for VAT relief and VAT is always payable on delivery charges.

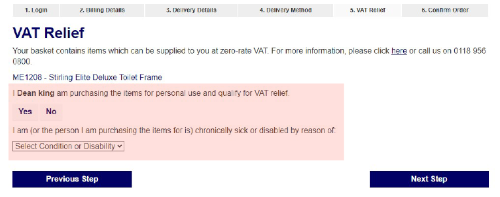

How do I claim VAT relief?

You can claim VAT relief by making a simple declaration during the checkout process,

specifying the medical condition or disability and that the goods are for personal or domestic use.

For incontinence products, you only need to declare that the item is for personal or domestic use.

If you are unsure, please click here or contact us for more information.